HEADLINES / Today / November 3, 2024

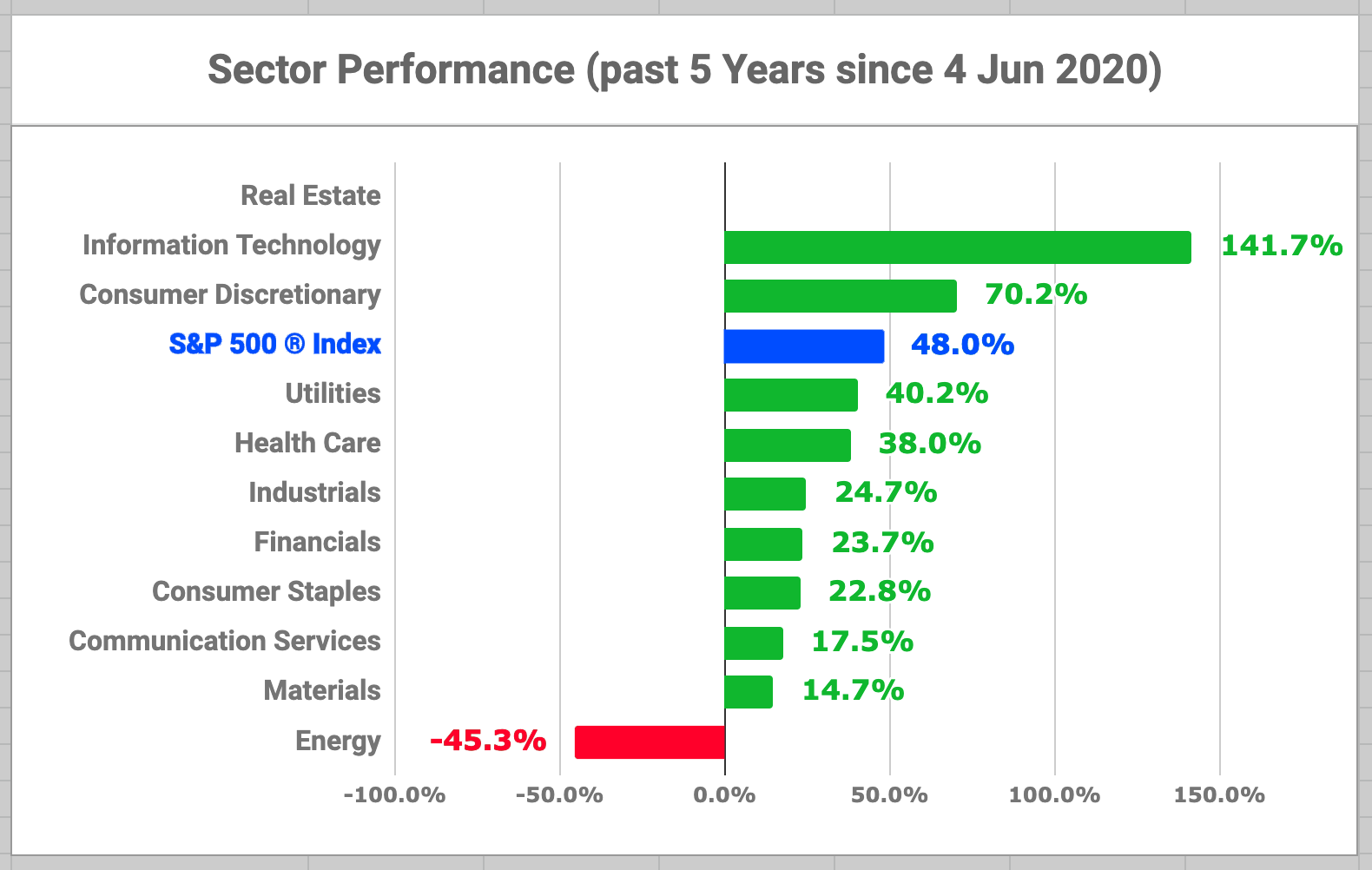

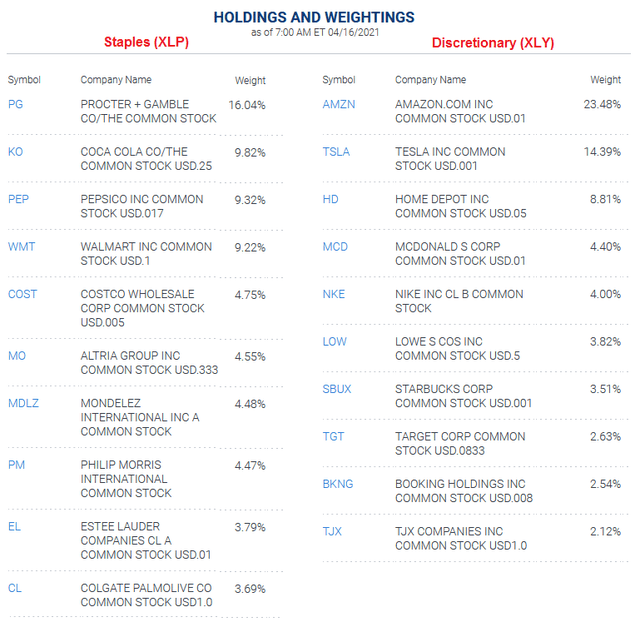

Changes Coming For Consumer Discretionary Staples Sectors Seeking Alpha

Seeking Alpha's top Quant picks in the Consumer Discretionary sector ahead of Q3 earnings: The Consumer Discretionary Select Sector SPDR Fund ETF ... In summary, XLY is a fund with a cheap expense ratio for investors seeking capital-weighted exposure in consumer cyclicals.. Consumer Confidence Rises In October: The two have diverged at brief periods and been highly correlated at others. ETFs associated with sentiment include: Consumer Discretionary Select Sector SPDR Fund (XLY).. Target: Insider Selling Signals Caution Amid Headwinds In Consumer Discretionary Spending: Consumer spending on discretionary items remains weak ...

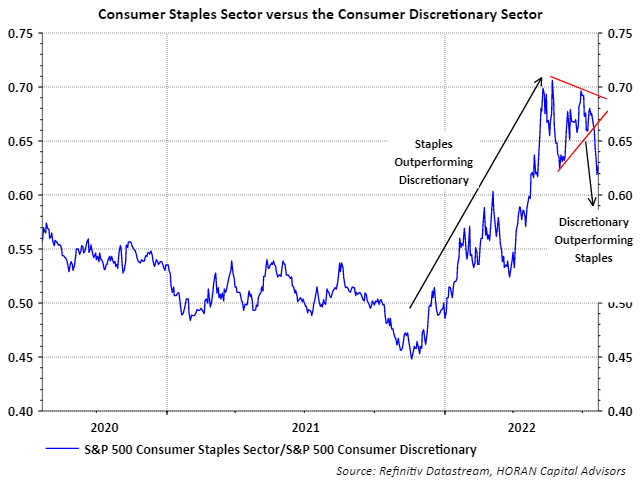

A Tale Of Two Consumer Sector Returns: Discretionary Vs. Staples | The ...

I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock .... ClearBridge Small Cap Strategy Q3 2024 Commentary: The ClearBridge Small Cap Strategy underperformed its Russell 2000 Index benchmark during the third quarter of 2024. Click here to read the full commentary.. SPLV: A Conservative Low-Volatility ETF: SPLV offers exposure to low-volatility stocks within the S&P 500, emphasizing financial services, consumer staples ...

2020 S&P 500 Sector Growth Rates Updated: Watch Consumer Discretionary ...

for it (other than from Seeking Alpha). I have no business relationship .... Madison International Stock Fund Q3 2024 Investment Strategy Letter: The MSCI ACWI ex-US index returned 8.06% in Q3 2024, with Emerging Markets leading and Europe and Japan lagging. The Fed's interest rate cut triggered a USD fall, boosting foreign currencies and .... Madison Small Cap Fund Q3 2024 Investment Strategy Letter: The Madison Small Cap Fund returned 6.3% in the third quarter of 2024. Performance lagged the Russell 2000’s return of 9.3% and Russell 2500’s return of 8.8%.

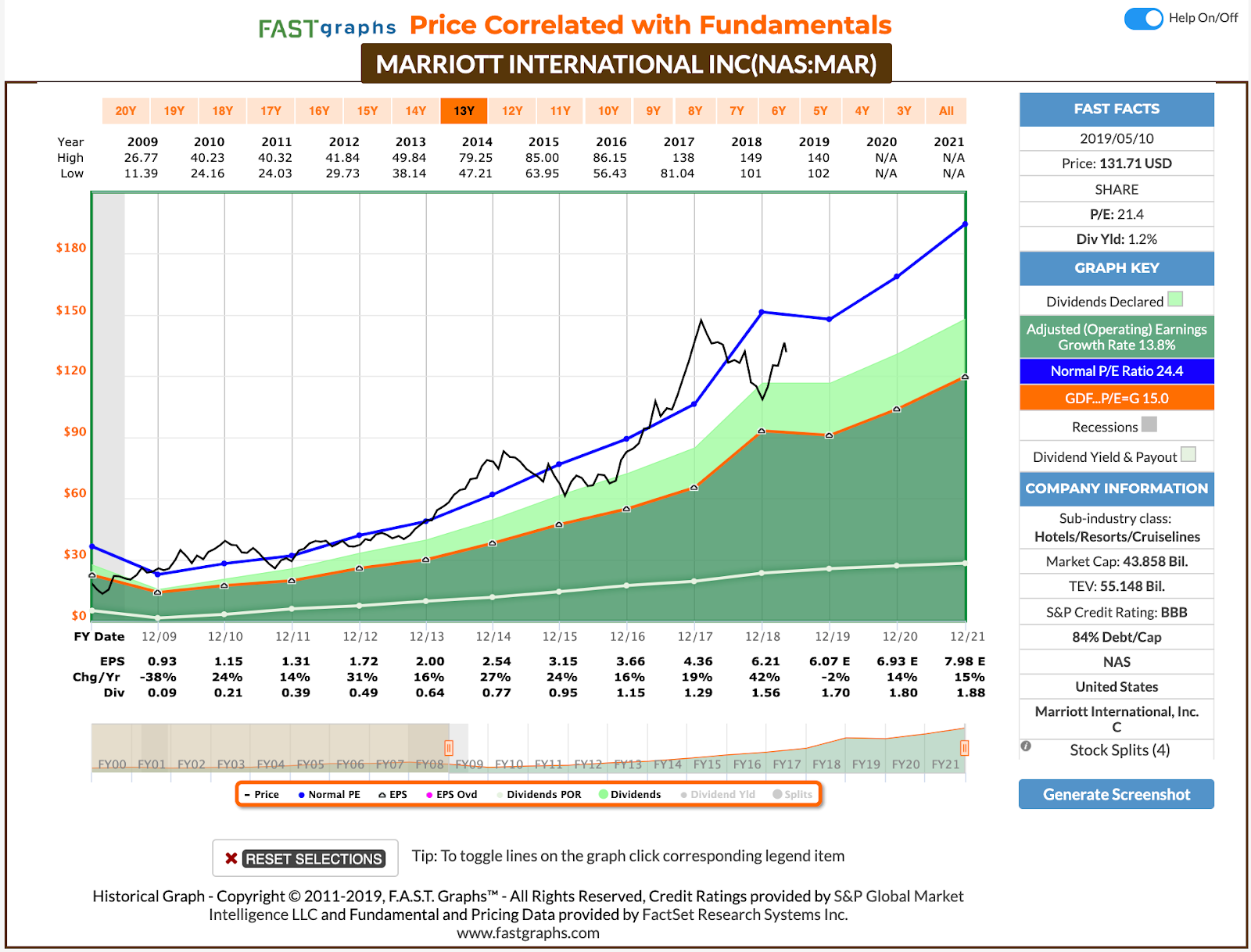

Dividend Increases: May 6-10, 2019 (Part 2: Consumer Discretionary And ...

New investment in Workiva, a cloud-based .... Heineken: Unchanged Guidance, Buy Confirmed: Heineken (HEINY) reiterated its fiscal year 2024 outlook with a core operating margin growth between 4% and 8%. Read why we maintain our buy rating on the stock.. S&P Global Q3: Accelerating Shares Buyback In Coming Weeks: As discussed in my previous article, the demand for refinancing is not discretionary ... receiving compensation for it (other than from Seeking Alpha). I have no business relationship with ....

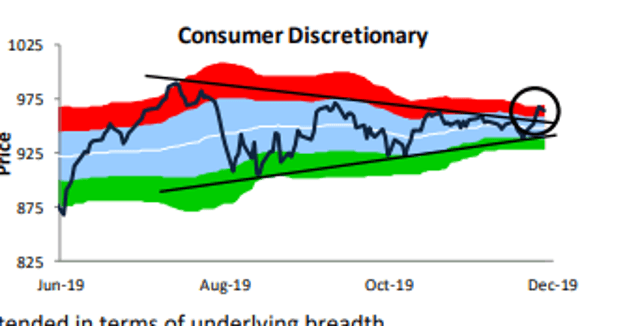

The Bulls Regain Some Footing (Technical Analysis) | Seeking Alpha

Week Ahead: Buckle Up - Turbulence Coming: UK: The UK sees mortgage and consumer credit reports in the coming days. Not only are they ... The correlation with changes in the yen has weakened as idiosyncratic developments have dominated ....

Portfolio Management 'Consumer Staples Or Consumer Discretionary' It's ...

Consumer Confidence Rises In October

The two have diverged at brief periods and been highly correlated at others. ETFs associated with sentiment include: Consumer Discretionary Select Sector SPDR Fund (XLY).

Week Ahead: Buckle Up - Turbulence Coming

UK: The UK sees mortgage and consumer credit reports in the coming days. Not only are they ... The correlation with changes in the yen has weakened as idiosyncratic developments have dominated ...

Target: Insider Selling Signals Caution Amid Headwinds In Consumer Discretionary Spending

Consumer spending on discretionary items remains weak ... I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock ...

S&P Global Q3: Accelerating Shares Buyback In Coming Weeks

As discussed in my previous article, the demand for refinancing is not discretionary ... receiving compensation for it (other than from Seeking Alpha). I have no business relationship with ...

Madison International Stock Fund Q3 2024 Investment Strategy Letter

The MSCI ACWI ex-US index returned 8.06% in Q3 2024, with Emerging Markets leading and Europe and Japan lagging. The Fed's interest rate cut triggered a USD fall, boosting foreign currencies and ...

Madison Small Cap Fund Q3 2024 Investment Strategy Letter

The Madison Small Cap Fund returned 6.3% in the third quarter of 2024. Performance lagged the Russell 2000’s return of 9.3% and Russell 2500’s return of 8.8%. New investment in Workiva, a cloud-based ...

Seeking Alpha's top Quant picks in the Consumer Discretionary sector ahead of Q3 earnings

The Consumer Discretionary Select Sector SPDR Fund ETF ... In summary, XLY is a fund with a cheap expense ratio for investors seeking capital-weighted exposure in consumer cyclicals.

Heineken: Unchanged Guidance, Buy Confirmed

Heineken (HEINY) reiterated its fiscal year 2024 outlook with a core operating margin growth between 4% and 8%. Read why we maintain our buy rating on the stock.

ClearBridge Small Cap Strategy Q3 2024 Commentary

The ClearBridge Small Cap Strategy underperformed its Russell 2000 Index benchmark during the third quarter of 2024. Click here to read the full commentary.

SPLV: A Conservative Low-Volatility ETF

SPLV offers exposure to low-volatility stocks within the S&P 500, emphasizing financial services, consumer staples ... for it (other than from Seeking Alpha). I have no business relationship ...

Related for Changes Coming For Consumer Discretionary Staples Sectors Seeking Alpha

It is a capital mistake to theorize before one has data. Insensibly one begins to twist facts to suit theories, instead of theories to suit facts.

Keep Yourself Updated By Following Our Stories From The Whole World

Keep yourself updated with the latest stories from across the globe! Our platform brings you real-time insights and breaking news, covering everything from major world events to inspiring local stories. By following our stories, you’ll stay informed on a diverse range of topics and perspectives from around the world. Whether it’s political shifts, cultural milestones, or groundbreaking innovations, we ensure you’re always connected to what matters most. Dive into our global coverage and stay informed, no matter where you are!