HEADLINES / Today / November 3, 2024

Consumer Protection Act 2010

A complete guide to the CFPB's open banking rule: The rule, finalized Tuesday, enables consumers to share their financial data with third parties. Here are the implications for banks.. CFPB Promotes Open Banking as it Issues Final Rule on Personal Financial Data Access Rights: Time will tell whether the Consumer Financial Protection Bureau's (CFPB) stated goals of accelerating "open banking" and competition will come .... CFPB Implements Groundbreaking Rule to Enhance Consumer Control Over Financial Data: The Consumer Financial Protection Bureau (CFPB) has finalized a transformative rule designed to significantly enhance consumer rights regarding personal financial data.

Consumer Protection Act: Safeguarding Your Rights - PATIL LEGAL SOLUTIONS

This landmark regulation .... CFPB Finalizes New Rule Expanding Consumer Financial Data Privacy Rights: The Consumer Financial Protection Bureau (CFPB) finalized a rule today that's expected to expand consumers rights, privacy, and security over their personal financial data.. New CFPB rules aim to boost competition in financial services: The Consumer Financial Protection Bureau (CFPB) on Tuesday unveiled rules intended to increase competition that would require financial institutions, credit card issuers and other financial ....

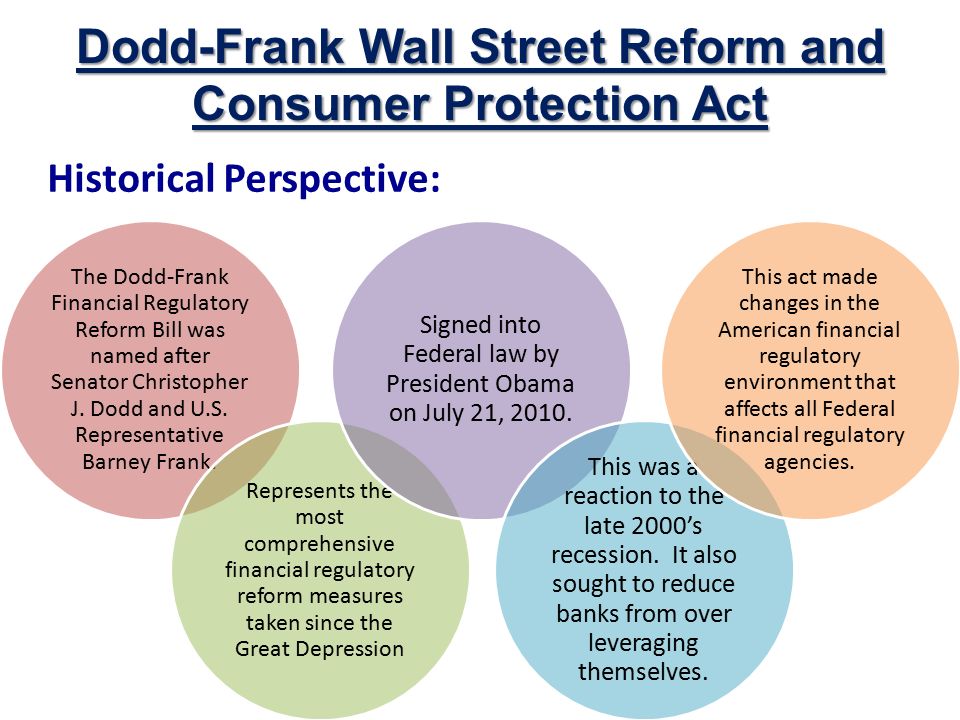

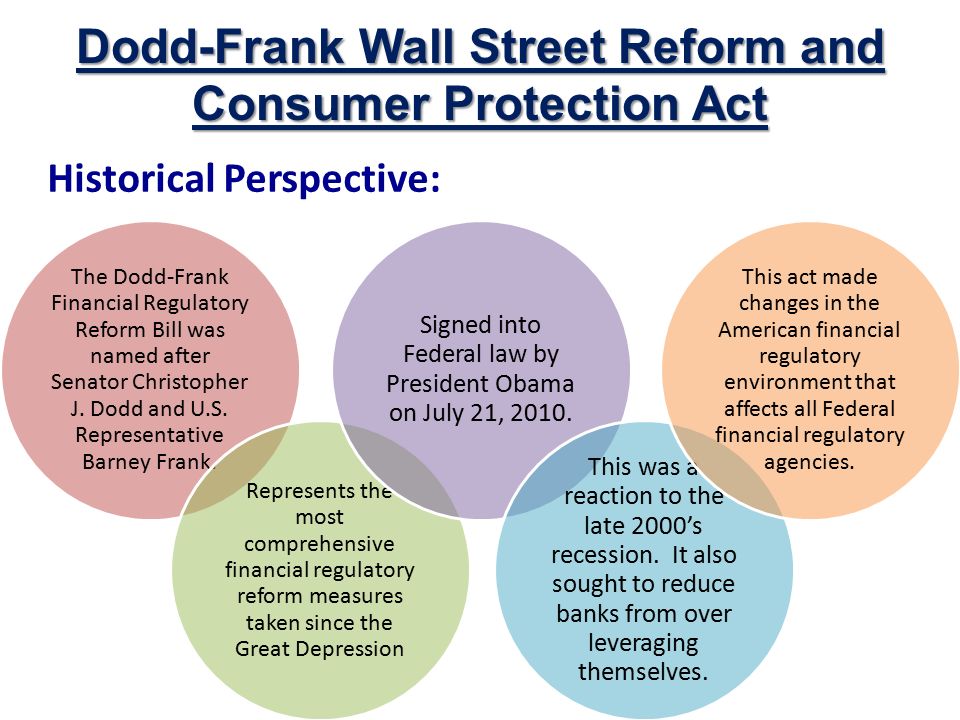

The Dodd-Frank Wall Street Reform & Consumer Protection Act Pt 1 ...

CFPB Issues Final Section 1033 Open Banking Rule: Legal Challenge Filed Immediately: This week, the Consumer Financial Protection Bureau (CFPB or Bureau) issued its final rule on personal financial data rights, purportedly aimed .... 'Open banking' rules will put your financial data back where it belongs: Well, at least eventually since some companies have until 2030 to comply The US Consumer Financial Protection Bureau (CFPB) has finalized a rule that requires banks, credit card issuers, and most ....

Consumer Protection Act 2019 And 1986: Importance, Scope, Laws, Rights

CFPB finalizes rule that lays the foundation for open banking: The rule requires financial providers, including mortgage companies, to share personal financial data with peers when customers request it.. 'Open Banking' Rules for Consumer Data Unveiled by US Watchdog: The Consumer Financial Protection Bureau's "open banking" rule governs data sharing between fintech firms and traditional banks, allowing consumers to easily transfer their personal data between .... US rolls out ‘open banking’ rules to make sharing financial data easier: One aim for the rules is to make it easier for customers to use third-party apps and also stimulate more competition among banks.

Consumer Protection Act 1986

The US has about 4,000 banks, which range from behemoths such as .... Credit card late fees cost Americans billions a year — now they're capped at $8: On March 5, 2024, the Consumer Financial Protection ... since the passage of the CARD Act, according to the CFPB, from an average of $23 at the end of 2010 to $32 in 2022. The bureau alleges ....

CONSUMER PROTECTION ACT I Important Sections (NET/JRF, LLB EXAM) - YouTube

A complete guide to the CFPB's open banking rule

The rule, finalized Tuesday, enables consumers to share their financial data with third parties. Here are the implications for banks.

'Open Banking' Rules for Consumer Data Unveiled by US Watchdog

The Consumer Financial Protection Bureau's "open banking" rule governs data sharing between fintech firms and traditional banks, allowing consumers to easily transfer their personal data between ...

CFPB Issues Final Section 1033 Open Banking Rule: Legal Challenge Filed Immediately

This week, the Consumer Financial Protection Bureau (CFPB or Bureau) issued its final rule on personal financial data rights, purportedly aimed ...

New CFPB rules aim to boost competition in financial services

The Consumer Financial Protection Bureau (CFPB) on Tuesday unveiled rules intended to increase competition that would require financial institutions, credit card issuers and other financial ...

CFPB Promotes Open Banking as it Issues Final Rule on Personal Financial Data Access Rights

Time will tell whether the Consumer Financial Protection Bureau's (CFPB) stated goals of accelerating "open banking" and competition will come ...

US rolls out ‘open banking’ rules to make sharing financial data easier

One aim for the rules is to make it easier for customers to use third-party apps and also stimulate more competition among banks. The US has about 4,000 banks, which range from behemoths such as ...

CFPB finalizes rule that lays the foundation for open banking

The rule requires financial providers, including mortgage companies, to share personal financial data with peers when customers request it.

'Open banking' rules will put your financial data back where it belongs

Well, at least eventually since some companies have until 2030 to comply The US Consumer Financial Protection Bureau (CFPB) has finalized a rule that requires banks, credit card issuers, and most ...

CFPB Implements Groundbreaking Rule to Enhance Consumer Control Over Financial Data

The Consumer Financial Protection Bureau (CFPB) has finalized a transformative rule designed to significantly enhance consumer rights regarding personal financial data. This landmark regulation ...

Credit card late fees cost Americans billions a year — now they're capped at $8

On March 5, 2024, the Consumer Financial Protection ... since the passage of the CARD Act, according to the CFPB, from an average of $23 at the end of 2010 to $32 in 2022. The bureau alleges ...

CFPB Finalizes New Rule Expanding Consumer Financial Data Privacy Rights

The Consumer Financial Protection Bureau (CFPB) finalized a rule today that's expected to expand consumers rights, privacy, and security over their personal financial data.

Related for Consumer Protection Act 2010

It is a capital mistake to theorize before one has data. Insensibly one begins to twist facts to suit theories, instead of theories to suit facts.

Keep Yourself Updated By Following Our Stories From The Whole World

Keep yourself updated with the latest stories from across the globe! Our platform brings you real-time insights and breaking news, covering everything from major world events to inspiring local stories. By following our stories, you’ll stay informed on a diverse range of topics and perspectives from around the world. Whether it’s political shifts, cultural milestones, or groundbreaking innovations, we ensure you’re always connected to what matters most. Dive into our global coverage and stay informed, no matter where you are!