HEADLINES / Today / November 3, 2024

Etf Vs Index Funds What Is The Difference Mint

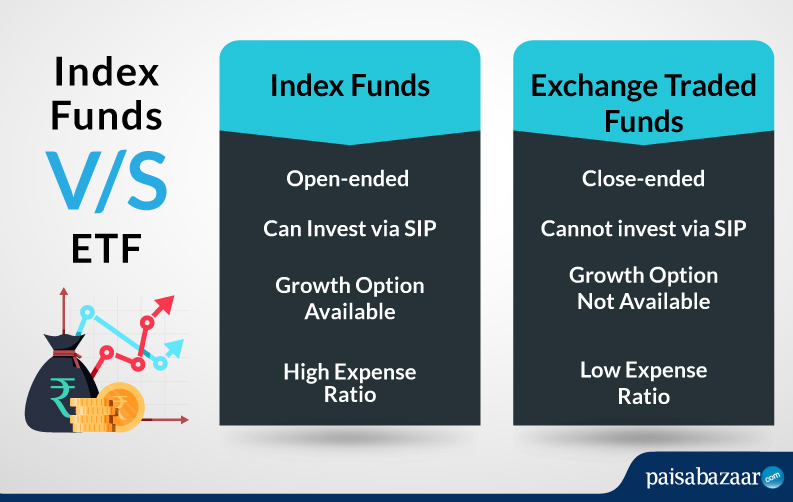

Index Fund vs. ETF: What's the Difference?: is the oldest surviving and largest ETF with annual returns of 8.21% since 2000. The significant difference between index funds and ETFs is how you buy shares in them and their flexibility.. What's the difference between ETFs and index funds?: Both types of funds are also usually passively managed, which provides cost savings and strong long-term returns. One major difference ... to their benchmark index. An ETF is an investment vehicle .... Vanguard Mutual Funds vs.

ETFs Vs Index Funds: The Differences Simplified - YouTube

Vanguard ETFs: What’s the Difference?: The Bottom Line Most Vanguard index mutual funds have a corresponding ETF. The most significant difference between mutual funds and ETFs is how tradable the shares are. ETFs can be bought and .... 5 Best S&P 500 Index Funds Of November 2024: What’s the Difference Between Index Funds and ETFs? For most people, S&P 500 index funds and ETFs are functionally the same, and you’ll want to choose whichever fund—whether index or ETF .... Index Funds vs. Mutual Funds: What's the Difference?: Funds offer instant portfolio diversification with very little work.

Choosing Between Index ETFs And Index Funds | BlinkX Blogs

You don't have to stay informed on dozens of stocks when a fund does it all for you. Index funds are passive funds that mirror .... Investing in Index Funds: Why You Should Invest: Index fund turnover ratios are usually about 1% to 2% per year, compared to 20% or higher for some actively managed mutual funds. If a fund sells a stock for profit, then the difference between .... What is PSU Bank ETF?: Exchange-Traded Funds ... ETF shares. The difference is included in the returns on investment and passed to the customers.

ETF Vs Mutual Fund Vs Index Fund: Similarities & Differences

ETFs, especially PSU Bank ETFs, actively track the traded market index.. What Are Managed Funds In Australia?: However, the higher potential returns offered by actively managed funds often come with higher management fees. Passively managed funds, often called index ... the difference between an ETF .... 6 Higher Yielding Cash Alternatives For Your Portfolio: PIMCO Enhanced Short Maturity Active ETF (MINT) MINT has been one of my favorite ultra short bond ETFs even though it has the highest expense ratio of the funds ...

ETF Vs Index Funds: 6 Factors To Know Which Is Better To Invest

What's the difference between .... ETF vs. Index Fund: Both types of funds are also usually passively managed, which provides cost savings and strong long-term returns. One major difference ... says. "ETF issuers can choose to track an index or .... ETF vs. Mutual Fund: What's the Difference?: Again, index funds will generally have lower expense ratios than actively managed mutual funds, and the expense ratios are often identical to their ETF counterparts. Since you must buy and hold .... Mutual Fund vs.

#1 ETF Vs Index Fund: Best Understanding The Key Differences

ETF: What's the Difference?: Mutual funds and exchange-traded ... not the structure of the investment. Do Index ETF vs. Mutual Fund Fees Differ Given the Same Passive Strategy? The difference in fees is marginal in many ....

ETF Vs Index Funds - What's The Difference Between The Two?

Mutual Fund vs. ETF: What's the Difference?

Mutual funds and exchange-traded ... not the structure of the investment. Do Index ETF vs. Mutual Fund Fees Differ Given the Same Passive Strategy? The difference in fees is marginal in many ...

Vanguard Mutual Funds vs. Vanguard ETFs: What’s the Difference?

The Bottom Line Most Vanguard index mutual funds have a corresponding ETF. The most significant difference between mutual funds and ETFs is how tradable the shares are. ETFs can be bought and ...

Index Funds vs. Mutual Funds: What's the Difference?

Funds offer instant portfolio diversification with very little work. You don't have to stay informed on dozens of stocks when a fund does it all for you. Index funds are passive funds that mirror ...

ETF vs. Mutual Fund: What's the Difference?

Again, index funds will generally have lower expense ratios than actively managed mutual funds, and the expense ratios are often identical to their ETF counterparts. Since you must buy and hold ...

ETF vs. Index Fund

Both types of funds are also usually passively managed, which provides cost savings and strong long-term returns. One major difference ... says. "ETF issuers can choose to track an index or ...

6 Higher Yielding Cash Alternatives For Your Portfolio

PIMCO Enhanced Short Maturity Active ETF (MINT) MINT has been one of my favorite ultra short bond ETFs even though it has the highest expense ratio of the funds ... What's the difference between ...

What's the difference between ETFs and index funds?

Both types of funds are also usually passively managed, which provides cost savings and strong long-term returns. One major difference ... to their benchmark index. An ETF is an investment vehicle ...

Index Fund vs. ETF: What's the Difference?

is the oldest surviving and largest ETF with annual returns of 8.21% since 2000. The significant difference between index funds and ETFs is how you buy shares in them and their flexibility.

What is PSU Bank ETF?

Exchange-Traded Funds ... ETF shares. The difference is included in the returns on investment and passed to the customers. ETFs, especially PSU Bank ETFs, actively track the traded market index.

5 Best S&P 500 Index Funds Of November 2024

What’s the Difference Between Index Funds and ETFs? For most people, S&P 500 index funds and ETFs are functionally the same, and you’ll want to choose whichever fund—whether index or ETF ...

Investing in Index Funds: Why You Should Invest

Index fund turnover ratios are usually about 1% to 2% per year, compared to 20% or higher for some actively managed mutual funds. If a fund sells a stock for profit, then the difference between ...

What Are Managed Funds In Australia?

However, the higher potential returns offered by actively managed funds often come with higher management fees. Passively managed funds, often called index ... the difference between an ETF ...

Related for Etf Vs Index Funds What Is The Difference Mint

It is a capital mistake to theorize before one has data. Insensibly one begins to twist facts to suit theories, instead of theories to suit facts.

Keep Yourself Updated By Following Our Stories From The Whole World

Keep yourself updated with the latest stories from across the globe! Our platform brings you real-time insights and breaking news, covering everything from major world events to inspiring local stories. By following our stories, you’ll stay informed on a diverse range of topics and perspectives from around the world. Whether it’s political shifts, cultural milestones, or groundbreaking innovations, we ensure you’re always connected to what matters most. Dive into our global coverage and stay informed, no matter where you are!