HEADLINES / Today / November 3, 2024

Index Funds Vs Etfs Vs Mutual Funds Which Is Best

ETF vs. Mutual Fund vs. Index Fund - NerdWallet: That said, you may need to pay a commission fee to purchase ETFs, whereas mutual funds don’t usually charge a fee when buying or selling. Even though index funds generally have lower MERs than .... Differences Between ETFs vs. Index Funds vs. Mutual Funds - SmartAsset: ETFs, index funds and mutual funds are investment options that work for many portfolios. Here are the key differences for your investments.. ETFs vs. Index Mutual Funds: What's the Difference?

Index Funds Vs. ETFs Vs. Mutual Funds: Which Is Best? - YouTube

- Investopedia: ETFs are more tax efficient than index funds because they are structured to have fewer taxable events. As mentioned previously, an index mutual fund must constantly rebalance to match the tracked .... ETF vs Index Fund: Which to Choose - Wealthsimple: More conservative or cautious investors may prefer index funds to ETFs, while investors who want to benefit from exposure to more types of assets or want to take advantage of real-time pricings during the trading day may prefer ETFs.

Index Funds Vs Mutual Funds | Meaning, Differences, Pros & Cons

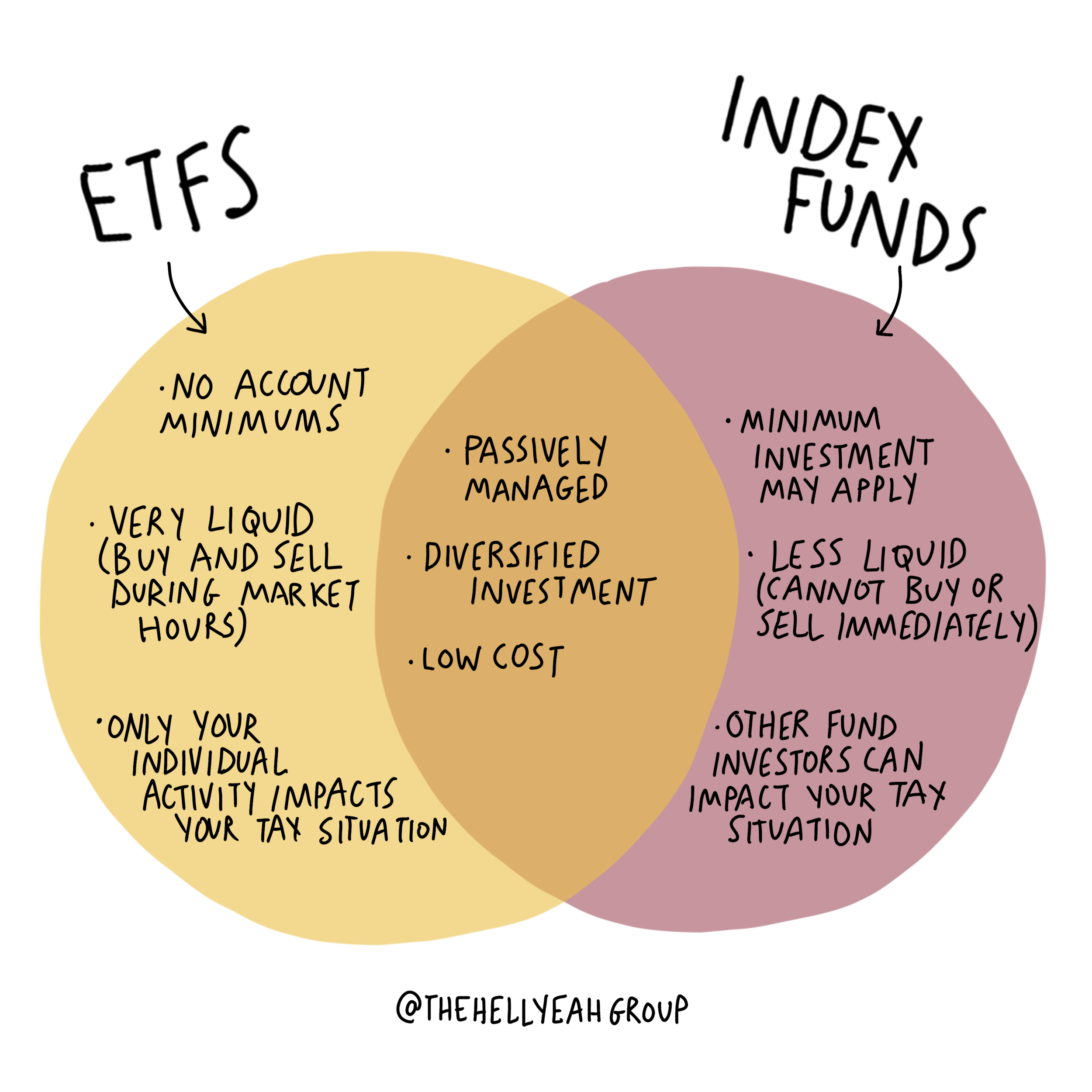

Ultimately, it all comes down to personal preference and financial goals. ETFs and index funds are two types of .... ETF vs. Index Fund: The Difference and Which to Use: Key Takeaways. Index funds track an underlying index. Both exchange-traded funds (ETFs) and mutual funds can be index funds if their goal is to track the return of a benchmark index. ETFs and .... ETFs Vs. Index Funds: Which Are Better? | Bankrate: In 2022, the average expense ratio for index equity mutual funds was 0.05 percent, according to the Investment Company Institute’s latest report. For equity ETFs, it was 0.16 percent. On the .... Mutual Fund vs. ETF: What's the Difference? - Investopedia: Mutual funds are usually actively managed. Index funds are passively managed and have become more popular. ETFs are usually passively managed and track a market index or sector sub-index. ETFs can .... ETF vs. Index Fund: What Are the Differences? - The Motley Fool: 1. Fees and expenses. The primary difference between ETFs and index funds is how they're bought and sold. ETFs trade on an exchange just like stocks, and you buy or sell them through a broker ....

Mutual Funds Vs ETFs - Financial Edge

ETFs Vs. Index Funds: Which Are Better? | Bankrate

In 2022, the average expense ratio for index equity mutual funds was 0.05 percent, according to the Investment Company Institute’s latest report. For equity ETFs, it was 0.16 percent. On the ...

ETF vs Index Fund: Which to Choose - Wealthsimple

More conservative or cautious investors may prefer index funds to ETFs, while investors who want to benefit from exposure to more types of assets or want to take advantage of real-time pricings during the trading day may prefer ETFs. Ultimately, it all comes down to personal preference and financial goals. ETFs and index funds are two types of ...

ETF vs. Index Fund: What Are the Differences? - The Motley Fool

1. Fees and expenses. The primary difference between ETFs and index funds is how they're bought and sold. ETFs trade on an exchange just like stocks, and you buy or sell them through a broker ...

ETFs vs. Index Mutual Funds: What's the Difference? - Investopedia

ETFs are more tax efficient than index funds because they are structured to have fewer taxable events. As mentioned previously, an index mutual fund must constantly rebalance to match the tracked ...

Differences Between ETFs vs. Index Funds vs. Mutual Funds - SmartAsset

ETFs, index funds and mutual funds are investment options that work for many portfolios. Here are the key differences for your investments.

ETF vs. Index Fund: The Difference and Which to Use

Key Takeaways. Index funds track an underlying index. Both exchange-traded funds (ETFs) and mutual funds can be index funds if their goal is to track the return of a benchmark index. ETFs and ...

Mutual Fund vs. ETF: What's the Difference? - Investopedia

Mutual funds are usually actively managed. Index funds are passively managed and have become more popular. ETFs are usually passively managed and track a market index or sector sub-index. ETFs can ...

ETF vs. Mutual Fund vs. Index Fund - NerdWallet

That said, you may need to pay a commission fee to purchase ETFs, whereas mutual funds don’t usually charge a fee when buying or selling. Even though index funds generally have lower MERs than ...

Related for Index Funds Vs Etfs Vs Mutual Funds Which Is Best

It is a capital mistake to theorize before one has data. Insensibly one begins to twist facts to suit theories, instead of theories to suit facts.

Keep Yourself Updated By Following Our Stories From The Whole World

Keep yourself updated with the latest stories from across the globe! Our platform brings you real-time insights and breaking news, covering everything from major world events to inspiring local stories. By following our stories, you’ll stay informed on a diverse range of topics and perspectives from around the world. Whether it’s political shifts, cultural milestones, or groundbreaking innovations, we ensure you’re always connected to what matters most. Dive into our global coverage and stay informed, no matter where you are!