HEADLINES / Today / November 3, 2024

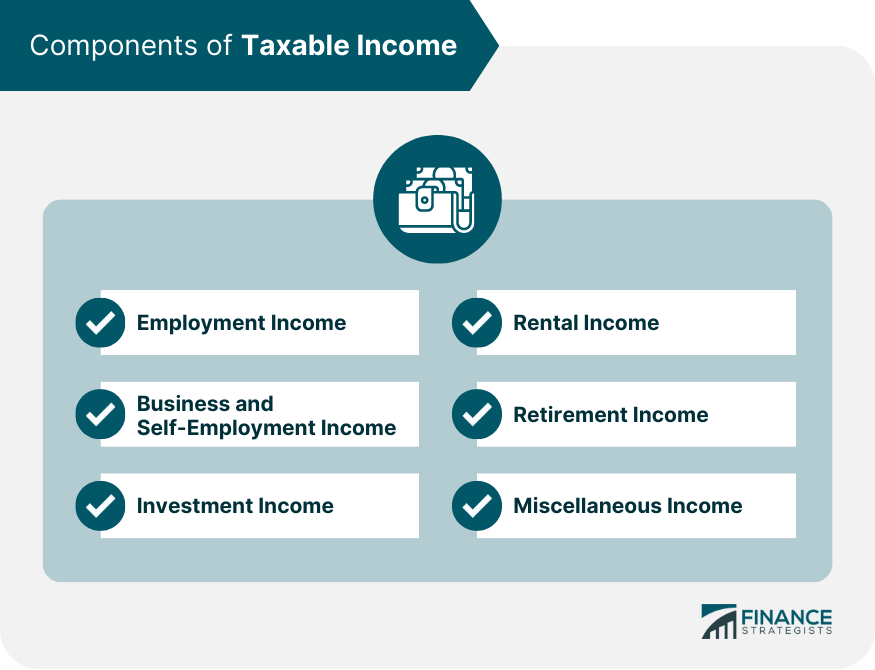

Taxable Income Definition Components Formula

Taxable Income: Definition, How to Calculate It: In short, taxable income is equal to adjusted gross income (AGI) minus standard or itemized deductions. Here is a slightly more detailed formula: Taxable income = gross income - (nontaxable income .... What is taxable income?: Taxable income is the amount of your gross income that's subject to taxes. It's used to calculate how much you owe to the government. Typically, it's equal to your adjusted gross income minus your .... Current Account Balance Definition: Formula, Components, and Uses: The four major components of a current account are goods, services, income, and current transfers.

Gross Income Vs. Taxable Income: What’s The Difference?

Calculating a country's current account balance will show if it has a deficit or a surplus.. Are My Social Security Disability Benefits Taxable?: In some situations and in some states, your Social Security disability benefits may be taxable. It depends on your income, which is calculated using a formula set by the Social Security .... Income Tax Calculator: IRA limits for 2023 have been escalated to $6,500, or your taxable income, for individuals under 50. Enter how many dependents you will claim on your 2022 tax return This calculator estimates the ....

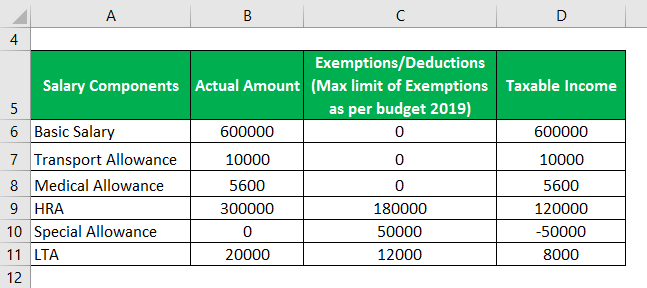

Taxable Income Formula | Calculator (Examples With Excel Template)

What is Net Income? A Comprehensive Overview: Let’s first understand the net income definition. Net income is the amount ... subtract any expenses that can lower your taxable income. Calculate Taxes: Figure out how much you owe in taxes .... Is social security taxable?: The total provisional income of $39,000 ($28,000 / 2 + $25,000) means up to 50% of your Social Security benefits are taxable if you file jointly. Since this figure is between $32,000 and $44,000 .... What Is Operating Income? Definition, Calculation & Example: Operating income measures a company’s efficiency and performance and is the profit after operating expenses have been subtracted from gross profit.

PPT - Taxable Income Formula For Individuals PowerPoint Presentation ...

Before delving further into operating income .... How Are Annuity Withdrawals Taxed?: starting either right away with an immediate annuity or in the future with a deferred income annuity. As mentioned above, each payment includes both taxable interest and tax-free return of your .... Current Account Balance Definition: Formula, Components, and Uses: The four major components of a current account are goods, services, income, and current transfers. Calculating a country's current account balance will show if it has a deficit or a surplus..

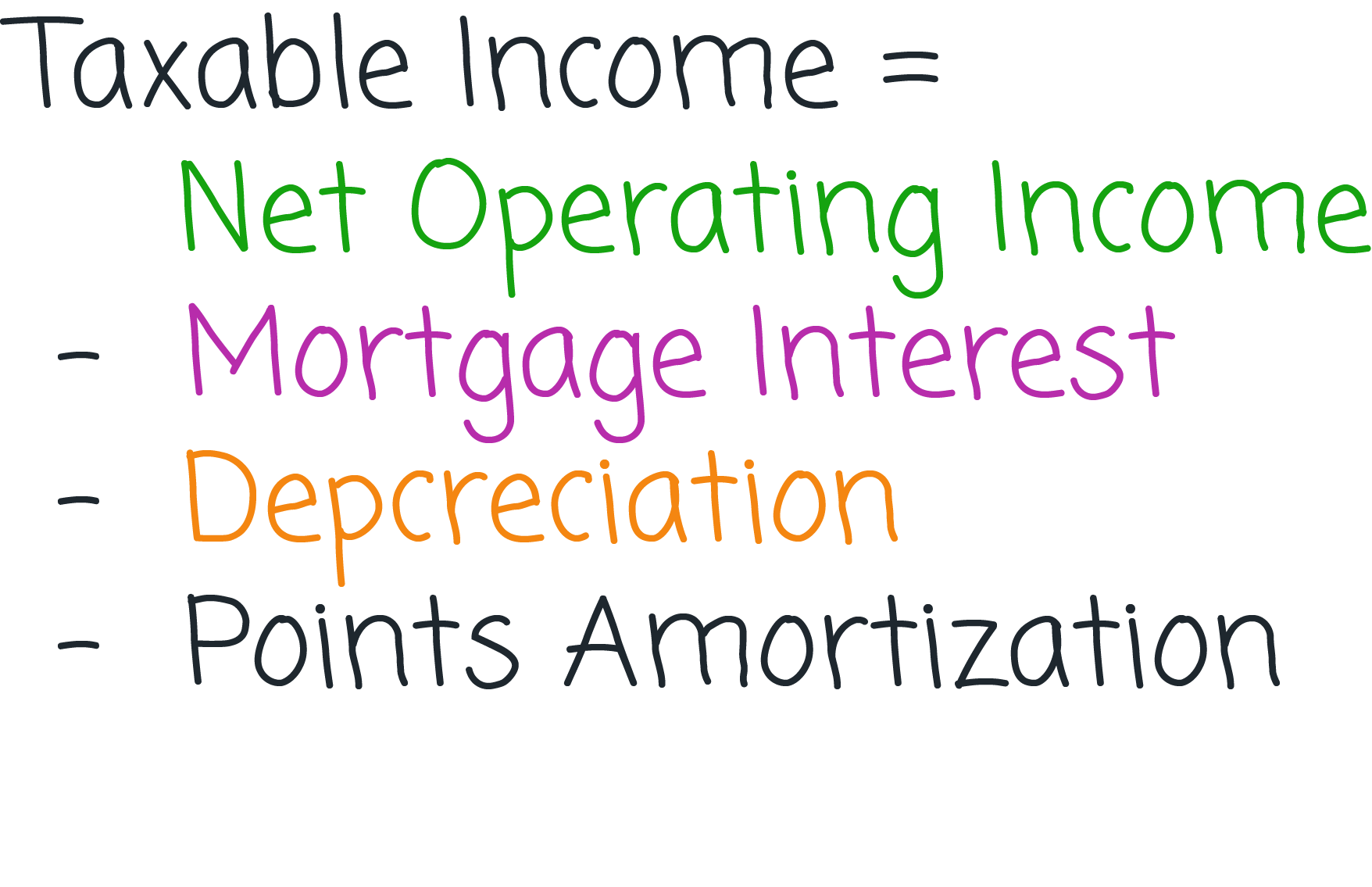

Taxable Income Calculation | Formula | Excel | Example | Zilculator ...

Taxable Income: What It Is and How to Calculate It: Knowing your taxable income (the amount of your income subject to federal tax that you must report on your federal tax return) is important for several reasons. The IRS requires that you report .... What Is Taxable Income?: With the tax season upon us, now is the time to take stock of all taxable income. While that may seem like a simple and straightforward task, it's not always so clear-cut, even if you're a ....

Individual Income Tax Formula/Sections Flashcards | Quizlet

Current Account Balance Definition: Formula, Components, and Uses

The four major components of a current account are goods, services, income, and current transfers. Calculating a country's current account balance will show if it has a deficit or a surplus.

What is Net Income? A Comprehensive Overview

Let’s first understand the net income definition. Net income is the amount ... subtract any expenses that can lower your taxable income. Calculate Taxes: Figure out how much you owe in taxes ...

Income Tax Calculator

IRA limits for 2023 have been escalated to $6,500, or your taxable income, for individuals under 50. Enter how many dependents you will claim on your 2022 tax return This calculator estimates the ...

How Are Annuity Withdrawals Taxed?

starting either right away with an immediate annuity or in the future with a deferred income annuity. As mentioned above, each payment includes both taxable interest and tax-free return of your ...

What is taxable income?

Taxable income is the amount of your gross income that's subject to taxes. It's used to calculate how much you owe to the government. Typically, it's equal to your adjusted gross income minus your ...

Is social security taxable?

The total provisional income of $39,000 ($28,000 / 2 + $25,000) means up to 50% of your Social Security benefits are taxable if you file jointly. Since this figure is between $32,000 and $44,000 ...

Taxable Income: What It Is and How to Calculate It

Knowing your taxable income (the amount of your income subject to federal tax that you must report on your federal tax return) is important for several reasons. The IRS requires that you report ...

Are My Social Security Disability Benefits Taxable?

In some situations and in some states, your Social Security disability benefits may be taxable. It depends on your income, which is calculated using a formula set by the Social Security ...

What Is Taxable Income?

With the tax season upon us, now is the time to take stock of all taxable income. While that may seem like a simple and straightforward task, it's not always so clear-cut, even if you're a ...

Taxable Income: Definition, How to Calculate It

In short, taxable income is equal to adjusted gross income (AGI) minus standard or itemized deductions. Here is a slightly more detailed formula: Taxable income = gross income - (nontaxable income ...

What Is Operating Income? Definition, Calculation & Example

Operating income measures a company’s efficiency and performance and is the profit after operating expenses have been subtracted from gross profit. Before delving further into operating income ...

Current Account Balance Definition: Formula, Components, and Uses

The four major components of a current account are goods, services, income, and current transfers. Calculating a country's current account balance will show if it has a deficit or a surplus.

Related for Taxable Income Definition Components Formula

It is a capital mistake to theorize before one has data. Insensibly one begins to twist facts to suit theories, instead of theories to suit facts.

Keep Yourself Updated By Following Our Stories From The Whole World

Keep yourself updated with the latest stories from across the globe! Our platform brings you real-time insights and breaking news, covering everything from major world events to inspiring local stories. By following our stories, you’ll stay informed on a diverse range of topics and perspectives from around the world. Whether it’s political shifts, cultural milestones, or groundbreaking innovations, we ensure you’re always connected to what matters most. Dive into our global coverage and stay informed, no matter where you are!