HEADLINES / Today / November 3, 2024

Taxable Income Formula Financepal

Marginal Tax Rate: What It Is and How To Determine It, With Examples: Investopedia / Candra Huff Your marginal tax rate is the tax rate that you pay on your highest dollar of taxable income. The federal marginal tax rate for individuals in the United States .... What Is Federal Income Tax?: Tax brackets are progressive; higher income equals higher tax rate. Tax deductions lower taxable income, credits reduce tax owed directly. Understanding effective tax rate helps gauge actual tax .... What Is Adjusted Gross Income?

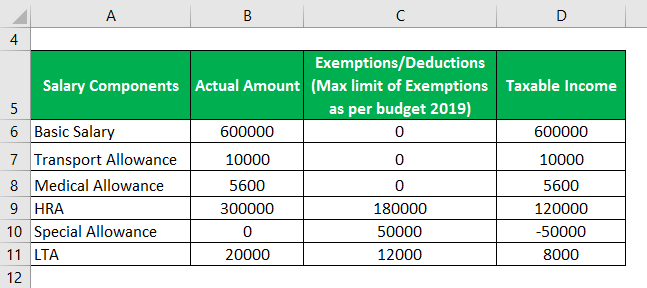

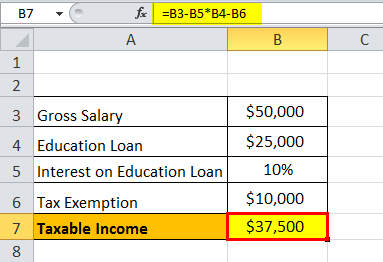

Taxable Income Formula (Examples) | How To Calculate Taxable Income?

How to Calculate It in 2022: Both income and exclusions are spelled out on the Schedule 1 tax form. Taxable income: Your AGI is not the same as your taxable income, but it is the basis for determining that figure. Once your .... Is social security taxable?: The total provisional income of $39,000 ($28,000 / 2 + $25,000) means up to 50% of your Social Security benefits are taxable if you file jointly. Since this figure is between $32,000 and $44,000 .... 2025 tax brackets: How much will you pay in federal income tax?: The standard deduction What is a marginal tax rate?

Taxable-income-formula - Coach Carson

How can I lower my taxable income? FAQs Offers in this section are from affiliate partners and selected based on a combination of engagement ....

Taxable Income Formula (Examples) | How To Calculate Taxable Income?

2025 tax brackets: How much will you pay in federal income tax?

The standard deduction What is a marginal tax rate? How can I lower my taxable income? FAQs Offers in this section are from affiliate partners and selected based on a combination of engagement ...

What Is Adjusted Gross Income? How to Calculate It in 2022

Both income and exclusions are spelled out on the Schedule 1 tax form. Taxable income: Your AGI is not the same as your taxable income, but it is the basis for determining that figure. Once your ...

Is social security taxable?

The total provisional income of $39,000 ($28,000 / 2 + $25,000) means up to 50% of your Social Security benefits are taxable if you file jointly. Since this figure is between $32,000 and $44,000 ...

What Is Federal Income Tax?

Tax brackets are progressive; higher income equals higher tax rate. Tax deductions lower taxable income, credits reduce tax owed directly. Understanding effective tax rate helps gauge actual tax ...

Marginal Tax Rate: What It Is and How To Determine It, With Examples

Investopedia / Candra Huff Your marginal tax rate is the tax rate that you pay on your highest dollar of taxable income. The federal marginal tax rate for individuals in the United States ...

Related for Taxable Income Formula Financepal

It is a capital mistake to theorize before one has data. Insensibly one begins to twist facts to suit theories, instead of theories to suit facts.

Keep Yourself Updated By Following Our Stories From The Whole World

Keep yourself updated with the latest stories from across the globe! Our platform brings you real-time insights and breaking news, covering everything from major world events to inspiring local stories. By following our stories, you’ll stay informed on a diverse range of topics and perspectives from around the world. Whether it’s political shifts, cultural milestones, or groundbreaking innovations, we ensure you’re always connected to what matters most. Dive into our global coverage and stay informed, no matter where you are!