HEADLINES / Today / November 3, 2024

What Is Income Tax And How Is It Calculated Hanover Mortgages

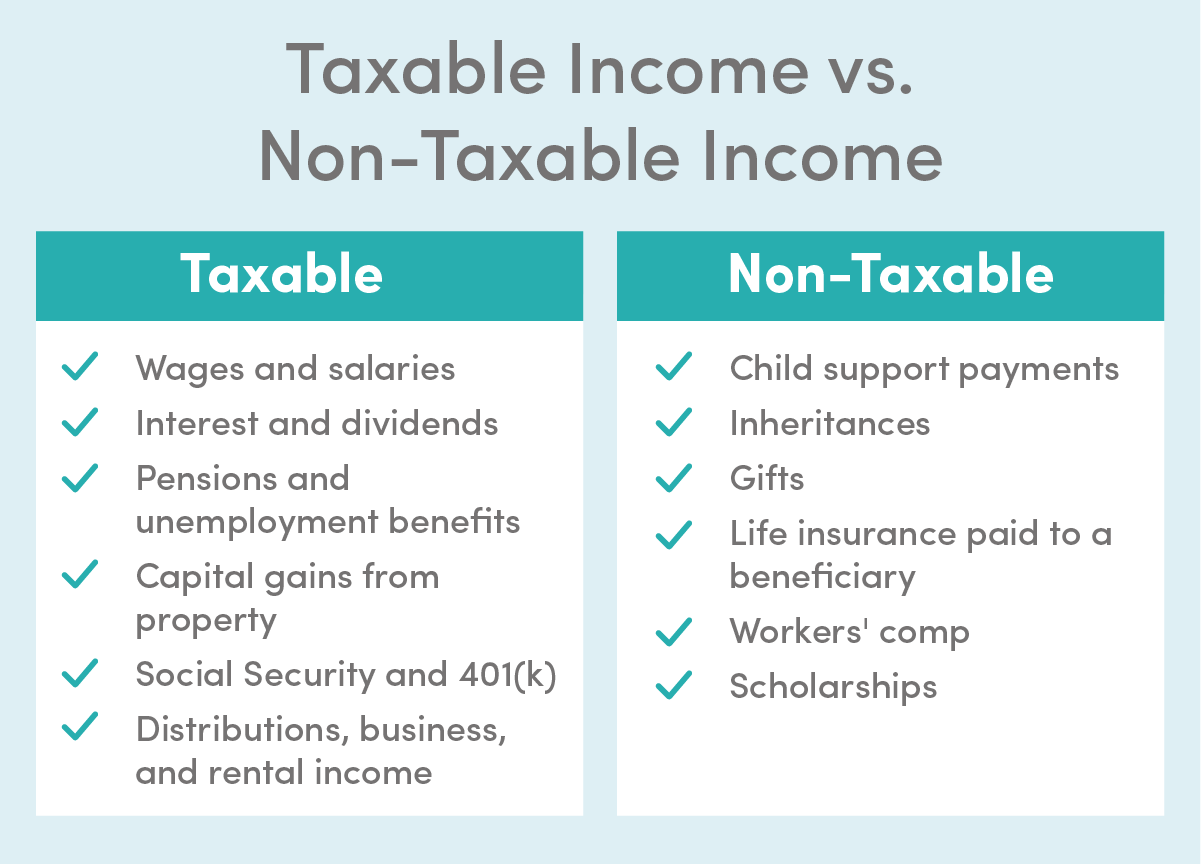

Ordinary Income: What It Is and How It’s Taxed: Lea Uradu, J.D. is a Maryland State Registered Tax Preparer ... at Target and earns $3,000 per month will have a calculated annual ordinary income of $36,000, or $3000 × 12 months.. Hobby Income: What It Is and How It’s Taxed: So, it is important to know your income type and how to claim it on your tax return. Reporting your income in the wrong area on your return can lead to processing delays and might even land you a .... Income tax: How it works, what you pay - and who forks out the most: For most people, income tax makes up the largest portion of the taxes they will pay over their lifetimes.

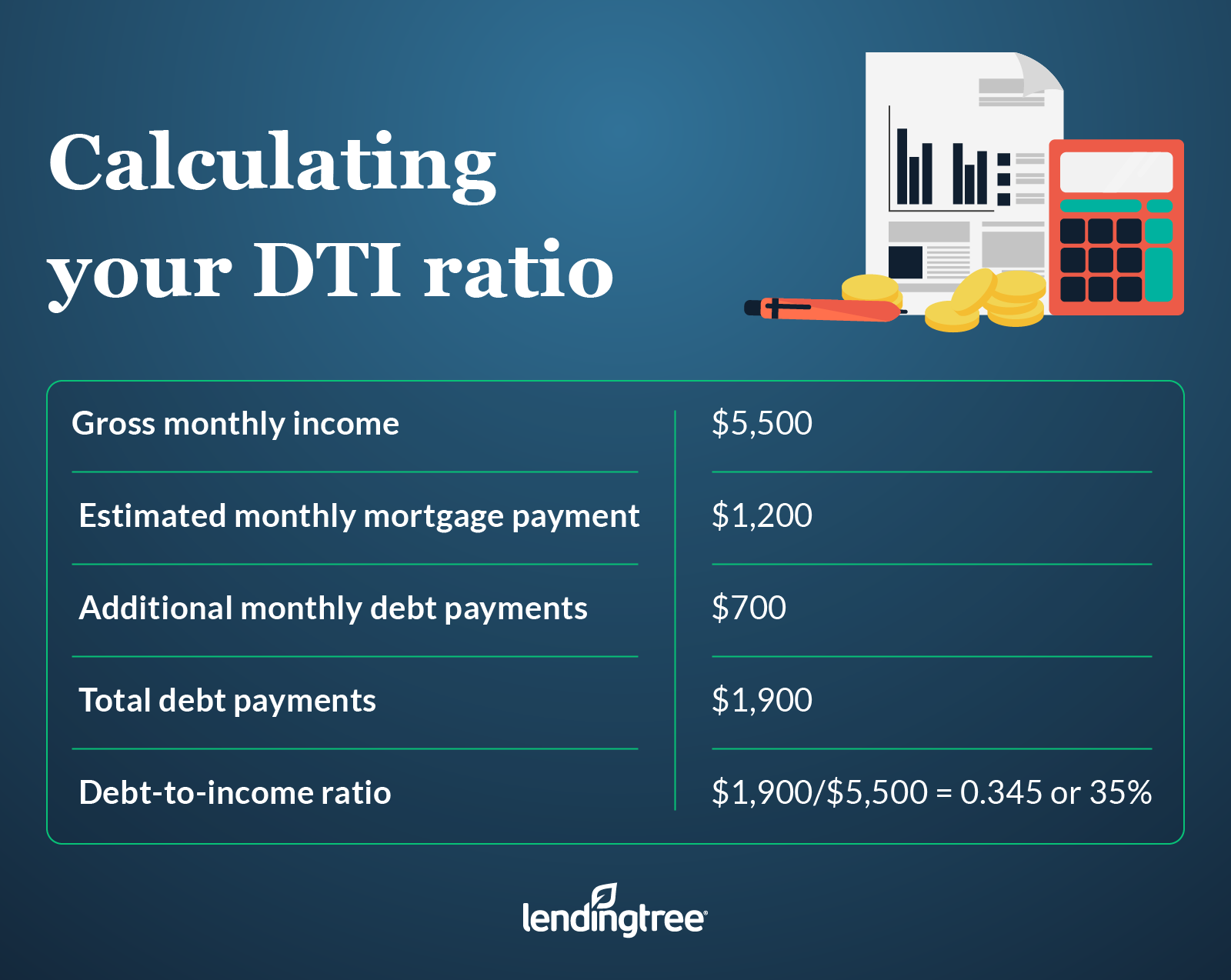

How To Calculate Your Debt-to-Income Ratio | LendingTree

It is also the UK Government's biggest tax source of revenue, accounting for 25 per cent .... What Is Federal Income Tax?: tax credits are applied after your tax is calculated and reduce the amount you owe dollar-for-dollar. In other words, if your federal income tax for 2023 is $15,000 and you have a $3,000 tax .... What Is Adjusted Gross Income? How to Calculate It in 2022: Adjusted gross income is a tax term everyone should understand. Also known as AGI, it has ramifications that extend beyond the tax season.

Tax Benefits On Home Loan: How To Save Tax Using Your Home Loan - The ...

“People are asking you all the time for your adjusted .... What Is a 1099 Form and What Should You Do With It?: Here’s everything you need to know about 1099s at tax time. A 1099 is a tax document that reports income you receive from sources other than an employer. You’ll get a 1099 if an organization .... How inheritance tax works - and what families MUST know: Heather Rogers, founder and owner of Aston Accountancy, is This is Money's tax columnist. She can answer your questions on any tax topic - tax codes, inheritance tax, income tax, capital gains tax ....

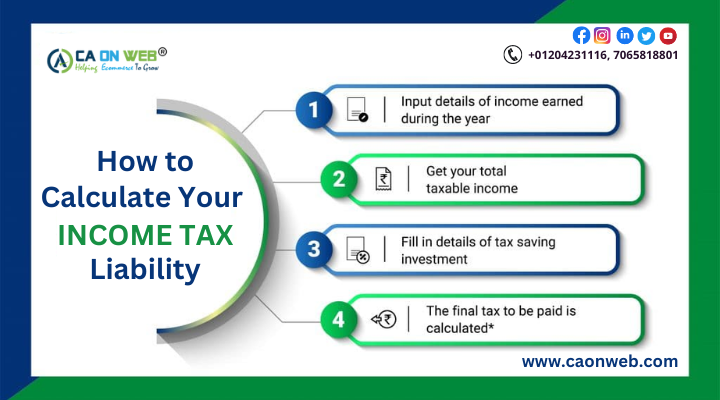

How To Calculate Your Income Tax Liability -CAONWEB

How much income does it take to crack the top 1%? A lot depends on where you live.: In West Virginia, you can join the top 1% with pre-tax income of about $420,000. In California or Connecticut, by contrast, you’d need a seven-figure salary. Those figures come from a recent .... What Is a Dividend Yield and How Is it Calculated?: In the UK, dividends are generally taxed based on an individual’s income tax bracket ... commentary about consumer credit products, loans, mortgages, insurance, savings and investment products ....

How Tax On Rental Income Is Calculated: Step-by-step Guide - Income Tax ...

How inheritance tax works - and what families MUST know

Heather Rogers, founder and owner of Aston Accountancy, is This is Money's tax columnist. She can answer your questions on any tax topic - tax codes, inheritance tax, income tax, capital gains tax ...

Hobby Income: What It Is and How It’s Taxed

So, it is important to know your income type and how to claim it on your tax return. Reporting your income in the wrong area on your return can lead to processing delays and might even land you a ...

What Is Adjusted Gross Income? How to Calculate It in 2022

Adjusted gross income is a tax term everyone should understand. Also known as AGI, it has ramifications that extend beyond the tax season. “People are asking you all the time for your adjusted ...

What Is Federal Income Tax?

tax credits are applied after your tax is calculated and reduce the amount you owe dollar-for-dollar. In other words, if your federal income tax for 2023 is $15,000 and you have a $3,000 tax ...

What Is a 1099 Form and What Should You Do With It?

Here’s everything you need to know about 1099s at tax time. A 1099 is a tax document that reports income you receive from sources other than an employer. You’ll get a 1099 if an organization ...

Ordinary Income: What It Is and How It’s Taxed

Lea Uradu, J.D. is a Maryland State Registered Tax Preparer ... at Target and earns $3,000 per month will have a calculated annual ordinary income of $36,000, or $3000 × 12 months.

What Is a Dividend Yield and How Is it Calculated?

In the UK, dividends are generally taxed based on an individual’s income tax bracket ... commentary about consumer credit products, loans, mortgages, insurance, savings and investment products ...

How much income does it take to crack the top 1%? A lot depends on where you live.

In West Virginia, you can join the top 1% with pre-tax income of about $420,000. In California or Connecticut, by contrast, you’d need a seven-figure salary. Those figures come from a recent ...

Income tax: How it works, what you pay - and who forks out the most

For most people, income tax makes up the largest portion of the taxes they will pay over their lifetimes. It is also the UK Government's biggest tax source of revenue, accounting for 25 per cent ...

Related for What Is Income Tax And How Is It Calculated Hanover Mortgages

It is a capital mistake to theorize before one has data. Insensibly one begins to twist facts to suit theories, instead of theories to suit facts.

Keep Yourself Updated By Following Our Stories From The Whole World

Keep yourself updated with the latest stories from across the globe! Our platform brings you real-time insights and breaking news, covering everything from major world events to inspiring local stories. By following our stories, you’ll stay informed on a diverse range of topics and perspectives from around the world. Whether it’s political shifts, cultural milestones, or groundbreaking innovations, we ensure you’re always connected to what matters most. Dive into our global coverage and stay informed, no matter where you are!