HEADLINES / Today / November 3, 2024

10 Best Consumer Discretionary Etfs Marketbeat

10 Best Consumer Discretionary ETFs - MarketBeat: To help get you started, we have compiled a list of some of the top ETFs for consumer discretionary spending. 1. Vanguard Consumer Discretionary ETF. The Vanguard Consumer Discretionary ETF NYSEARCA: VCR is an exchange-traded fund that invests in companies in the consumer discretionary sector of the economy.. Should You Invest in the Vanguard Consumer Discretionary ETF ...: The ETF has added roughly 12.06% so far this year and it's up approximately 35.96% in the last one year (as of 10/28/2024).

8 Best Consumer Discretionary Stocks | Adam Fayed

In that past 52-week period, it has traded between $253.43 and $341.94 .... Should You Invest in the Vanguard Consumer Discretionary ETF ...: The Vanguard Consumer Discretionary ETF (VCR) was launched on 01/26/2004, and is a passively managed exchange traded fund designed to offer broad exposure to the Consumer Discretionary - Broad .... 8 best consumer staples ETFs to buy now - MarketBeat: The First Trust Consumer Staples AlphaDEX Fund NYSE: FXG is an exchange-traded fund (ETF) that seeks to track the performance of the StrataQuant Consumer Staples Index.

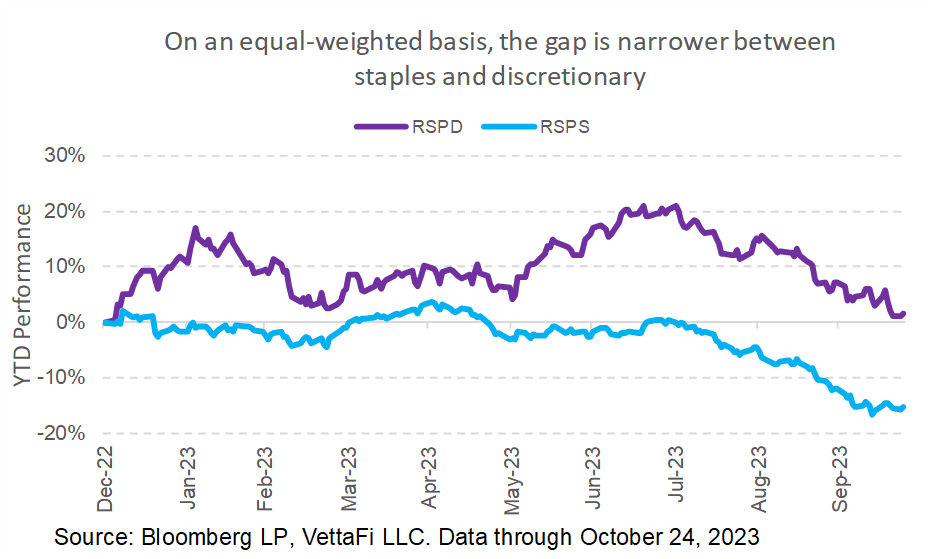

Consumer Discretionary Vs. Staples: What ETFs Can Tell Us

As of March 2023, the fund had a total of $735 million in assets under management and a dividend yield of 1.86%.. 8 Best Consumer Discretionary Stocks and ETFs to Buy: In keeping with the benchmark, the fund invests in a broad range of consumer discretionary stocks like McDonald's Corp. (MCD), Starbucks Corp. (SBUX) and TJX Cos. Inc. (TJX), each of which can be .... Vanguard Consumer Discretionary ETF (VCR) Price ... - MarketBeat: Vanguard Consumer Discretionary ETF's stock was trading at $304.55 on January 1st, 2024.

10 Top Consumer Discretionary ETFs To Buy | Kiplinger

Since then, VCR shares have increased by 11.3% and is now trading at $338.84. View the best growth stocks for 2024 here. Who are Vanguard Consumer Discretionary ETF's major shareholders?. 11 Best Consumer Discretionary Stocks of 2023 - Nasdaq: Consumer discretionary companies may operate in various industries, including luxury fashion, luxury consumer goods, entertainment and more. The MarketBeat top consumer discretionary stocks list .... Vanguard Consumer Discretionary ETF VCR ETF Analysis: ETFs Stocks Bonds Investing Ideas. Help What’s New Products for Investors. All Products and Services Vanguard Consumer Discretionary ETF VCR ETF Analysis | Medalist Rating as of Aug 31, 2024 ....

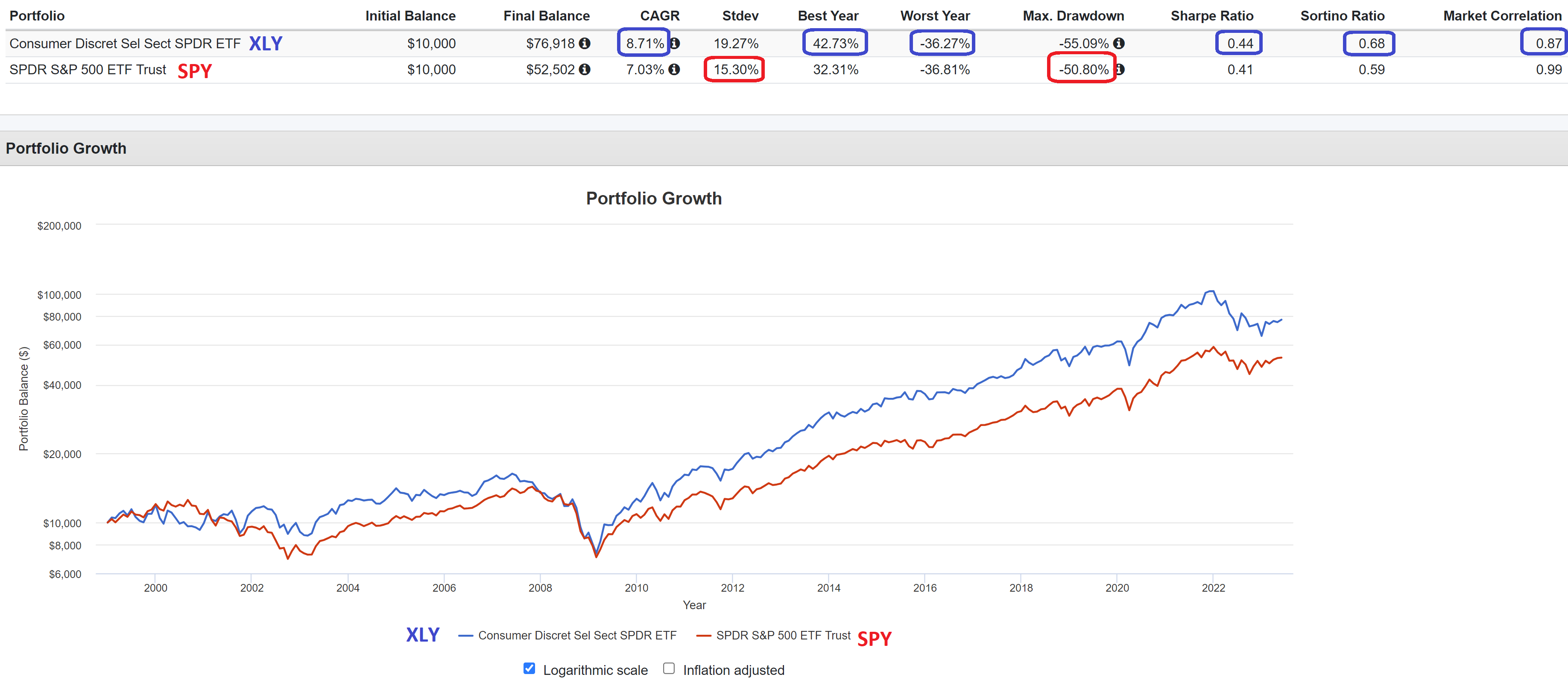

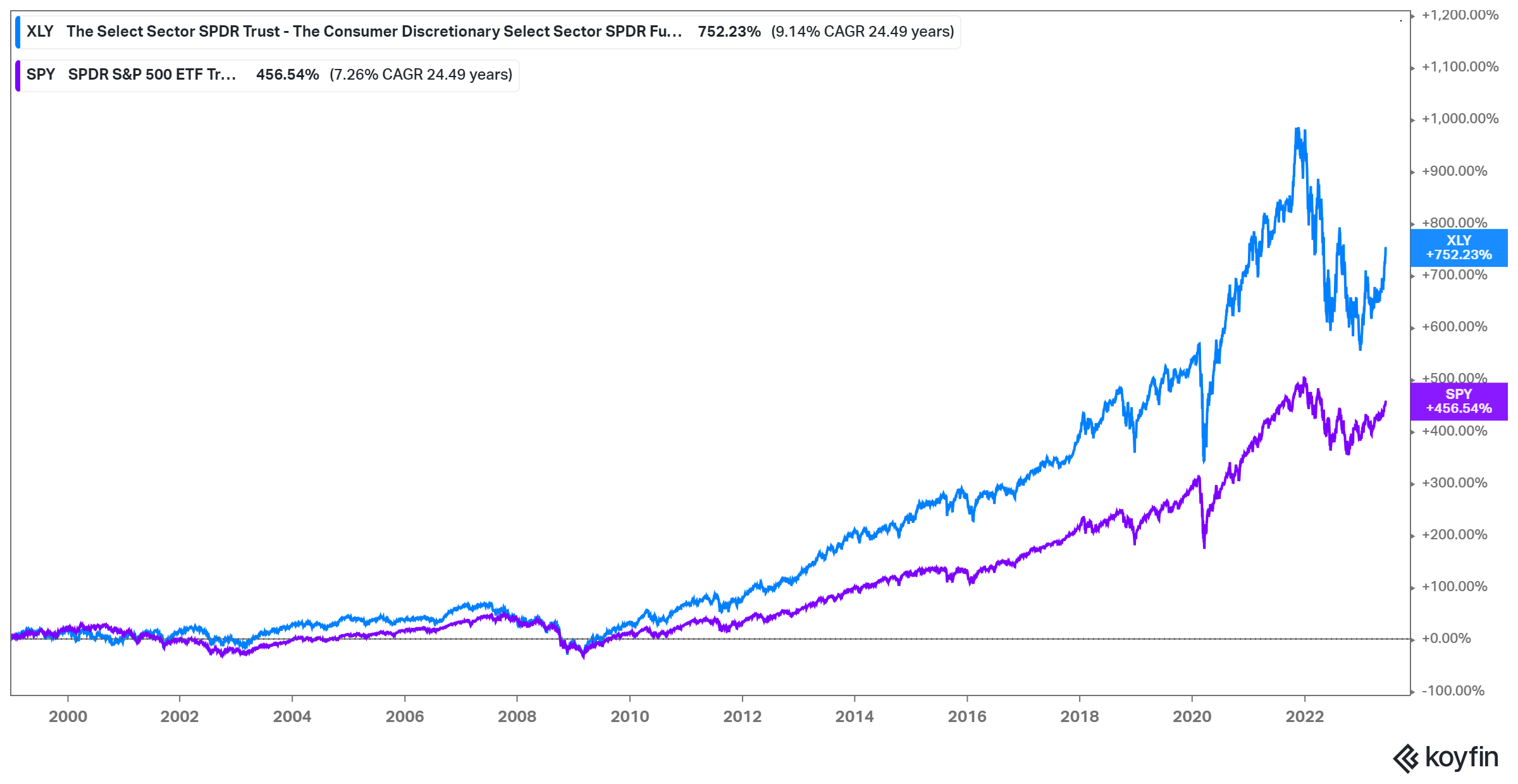

5 Best Consumer Discretionary Sector ETFs To Own Long-Term: VCR Vs XLY ...

Vanguard Consumer Discretionary ETF VCR ETF Analysis

ETFs Stocks Bonds Investing Ideas. Help What’s New Products for Investors. All Products and Services Vanguard Consumer Discretionary ETF VCR ETF Analysis | Medalist Rating as of Aug 31, 2024 ...

11 Best Consumer Discretionary Stocks of 2023 - Nasdaq

Consumer discretionary companies may operate in various industries, including luxury fashion, luxury consumer goods, entertainment and more. The MarketBeat top consumer discretionary stocks list ...

Vanguard Consumer Discretionary ETF (VCR) Price ... - MarketBeat

Vanguard Consumer Discretionary ETF's stock was trading at $304.55 on January 1st, 2024. Since then, VCR shares have increased by 11.3% and is now trading at $338.84. View the best growth stocks for 2024 here. Who are Vanguard Consumer Discretionary ETF's major shareholders?

8 Best Consumer Discretionary Stocks and ETFs to Buy

In keeping with the benchmark, the fund invests in a broad range of consumer discretionary stocks like McDonald's Corp. (MCD), Starbucks Corp. (SBUX) and TJX Cos. Inc. (TJX), each of which can be ...

10 Best Consumer Discretionary ETFs - MarketBeat

To help get you started, we have compiled a list of some of the top ETFs for consumer discretionary spending. 1. Vanguard Consumer Discretionary ETF. The Vanguard Consumer Discretionary ETF NYSEARCA: VCR is an exchange-traded fund that invests in companies in the consumer discretionary sector of the economy.

Should You Invest in the Vanguard Consumer Discretionary ETF ...

The Vanguard Consumer Discretionary ETF (VCR) was launched on 01/26/2004, and is a passively managed exchange traded fund designed to offer broad exposure to the Consumer Discretionary - Broad ...

8 best consumer staples ETFs to buy now - MarketBeat

The First Trust Consumer Staples AlphaDEX Fund NYSE: FXG is an exchange-traded fund (ETF) that seeks to track the performance of the StrataQuant Consumer Staples Index. As of March 2023, the fund had a total of $735 million in assets under management and a dividend yield of 1.86%.

Should You Invest in the Vanguard Consumer Discretionary ETF ...

The ETF has added roughly 12.06% so far this year and it's up approximately 35.96% in the last one year (as of 10/28/2024). In that past 52-week period, it has traded between $253.43 and $341.94 ...

Related for 10 Best Consumer Discretionary Etfs Marketbeat

It is a capital mistake to theorize before one has data. Insensibly one begins to twist facts to suit theories, instead of theories to suit facts.

Keep Yourself Updated By Following Our Stories From The Whole World

Keep yourself updated with the latest stories from across the globe! Our platform brings you real-time insights and breaking news, covering everything from major world events to inspiring local stories. By following our stories, you’ll stay informed on a diverse range of topics and perspectives from around the world. Whether it’s political shifts, cultural milestones, or groundbreaking innovations, we ensure you’re always connected to what matters most. Dive into our global coverage and stay informed, no matter where you are!