HEADLINES / Today / November 3, 2024

Consumer Reporting Companies Consumer Financial Protection Bureau

Consumer reporting companies | Consumer Financial Protection Bureau: You are also entitled to a free credit report every 12 months from each of the three nationwide consumer reporting companies—Equifax, TransUnion, and Experian. You can request a copy through AnnualCreditReport.com . As a result of a 2019 settlement, all U.S. consumers may also request up to six free copies of their Equifax credit report .... List of Consumer Reporting Companies - Consumer Financial Protection Bureau: Below is a list of consumer reporting companies updated for 2023.1 Consumer reporting companies collect information and provide reports about you to other companies (users).

Buying A House | Consumer Financial Protection Bureau

These users buy these reports to inform decisions about providing you with credit, employment, residential rental housing, insurance, and in other decision-making situations.. List of Consumer Reporting Companies - Consumer Financial Protection Bureau: presence on, or absence from, this list does not indicate whether the consumer reporting company is subject to the Bureau’s supervisory or enforcement authority. To provide your suggested corrections or additions to the li st, contact the Bureau at [email protected] and include “Consumer Reporting Company List” in the subject line..

Consumer Financial Protection Bureau Launches A Beta Site - Cleveland.com

Companies List | Consumer Financial Protection Bureau: The list includes the three nationwide consumer reporting companies—Equifax, TransUnion, and Experian—and several other reporting companies that focus on creating consumer reports for certain industries. This list is current as of January 2024. It includes entities that have identified themselves as “consumer reporting agencies” (as .... List of Consumer Reporting Companies - Consumer Financial Protection Bureau: All consumer reporting companies must provide you with a copy of your information for a reasonable fee (for calendar year 2024, the maximum allowable fee is $5.501 ).

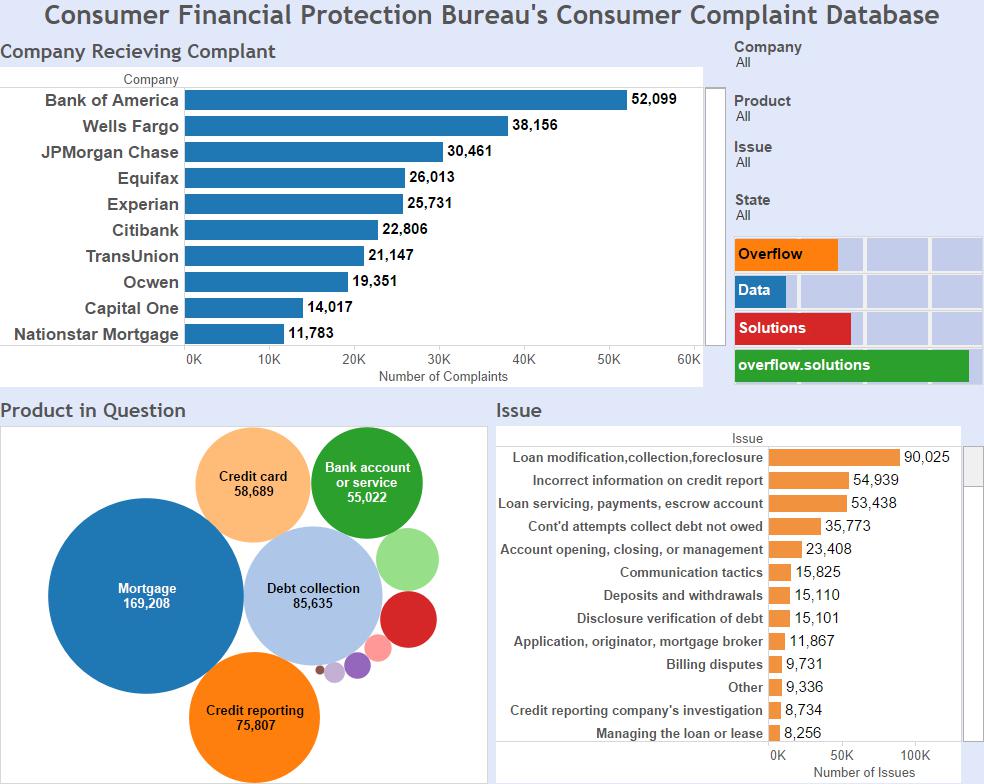

Consumer Financial Protection Bureau's Consumer Complaint Database ...

Requesting copies of your own consumer reports does not hurt your credit scores. Not every consumer reporting company will have information on every consumer. A reporting. Credit reports and scores - Consumer Financial Protection Bureau: Know the data on your credit report. You know your credit report is important, but the information that credit reporting companies use to create that report is just as important—and you have a right to see that data. Use our list of credit reporting companies to request and review each of your reports.

How The CFPB And TRID Will Change Your Home Buying Experience

Browse the list.. Consumer Financial Protection Bureau (CFPB) - USAGov: The Consumer Financial Protection Bureau (CFPB) helps consumers by providing educational materials and accepting complaints. It supervises banks, lenders, and large non-bank entities, such as credit reporting agencies and debt collection companies. The Bureau also works to make credit card, mortgage, and other loan disclosures clearer, so consumers can understand their rights and responsibilities.. Financial Consumer Agency of Canada: 2024-10-15.

What Is The CFPB Consumer Financial Protection Bureau?

The Financial Consumer Agency of Canada is responsible for protecting the rights and interests of consumers of financial products and services. It supervises federally regulated financial entities, such as banks, and strengthens the financial literacy of Canadians..

Andrew Gonzalez | Consumer Financial Protection Bureau

Consumer reporting companies | Consumer Financial Protection Bureau

You are also entitled to a free credit report every 12 months from each of the three nationwide consumer reporting companies—Equifax, TransUnion, and Experian. You can request a copy through AnnualCreditReport.com . As a result of a 2019 settlement, all U.S. consumers may also request up to six free copies of their Equifax credit report ...

Financial Consumer Agency of Canada

2024-10-15. The Financial Consumer Agency of Canada is responsible for protecting the rights and interests of consumers of financial products and services. It supervises federally regulated financial entities, such as banks, and strengthens the financial literacy of Canadians.

List of Consumer Reporting Companies - Consumer Financial Protection Bureau

presence on, or absence from, this list does not indicate whether the consumer reporting company is subject to the Bureau’s supervisory or enforcement authority. To provide your suggested corrections or additions to the li st, contact the Bureau at [email protected] and include “Consumer Reporting Company List” in the subject line.

Credit reports and scores - Consumer Financial Protection Bureau

Know the data on your credit report. You know your credit report is important, but the information that credit reporting companies use to create that report is just as important—and you have a right to see that data. Use our list of credit reporting companies to request and review each of your reports. Browse the list.

List of Consumer Reporting Companies - Consumer Financial Protection Bureau

Below is a list of consumer reporting companies updated for 2023.1 Consumer reporting companies collect information and provide reports about you to other companies (users). These users buy these reports to inform decisions about providing you with credit, employment, residential rental housing, insurance, and in other decision-making situations.

List of Consumer Reporting Companies - Consumer Financial Protection Bureau

All consumer reporting companies must provide you with a copy of your information for a reasonable fee (for calendar year 2024, the maximum allowable fee is $5.501 ). Requesting copies of your own consumer reports does not hurt your credit scores. Not every consumer reporting company will have information on every consumer. A reporting

Companies List | Consumer Financial Protection Bureau

The list includes the three nationwide consumer reporting companies—Equifax, TransUnion, and Experian—and several other reporting companies that focus on creating consumer reports for certain industries. This list is current as of January 2024. It includes entities that have identified themselves as “consumer reporting agencies” (as ...

Consumer Financial Protection Bureau (CFPB) - USAGov

The Consumer Financial Protection Bureau (CFPB) helps consumers by providing educational materials and accepting complaints. It supervises banks, lenders, and large non-bank entities, such as credit reporting agencies and debt collection companies. The Bureau also works to make credit card, mortgage, and other loan disclosures clearer, so consumers can understand their rights and responsibilities.

Related for Consumer Reporting Companies Consumer Financial Protection Bureau

It is a capital mistake to theorize before one has data. Insensibly one begins to twist facts to suit theories, instead of theories to suit facts.

Keep Yourself Updated By Following Our Stories From The Whole World

Keep yourself updated with the latest stories from across the globe! Our platform brings you real-time insights and breaking news, covering everything from major world events to inspiring local stories. By following our stories, you’ll stay informed on a diverse range of topics and perspectives from around the world. Whether it’s political shifts, cultural milestones, or groundbreaking innovations, we ensure you’re always connected to what matters most. Dive into our global coverage and stay informed, no matter where you are!