Different Types Of Life Insurance Explained Term Life Whole Life Universal Life Variable Life

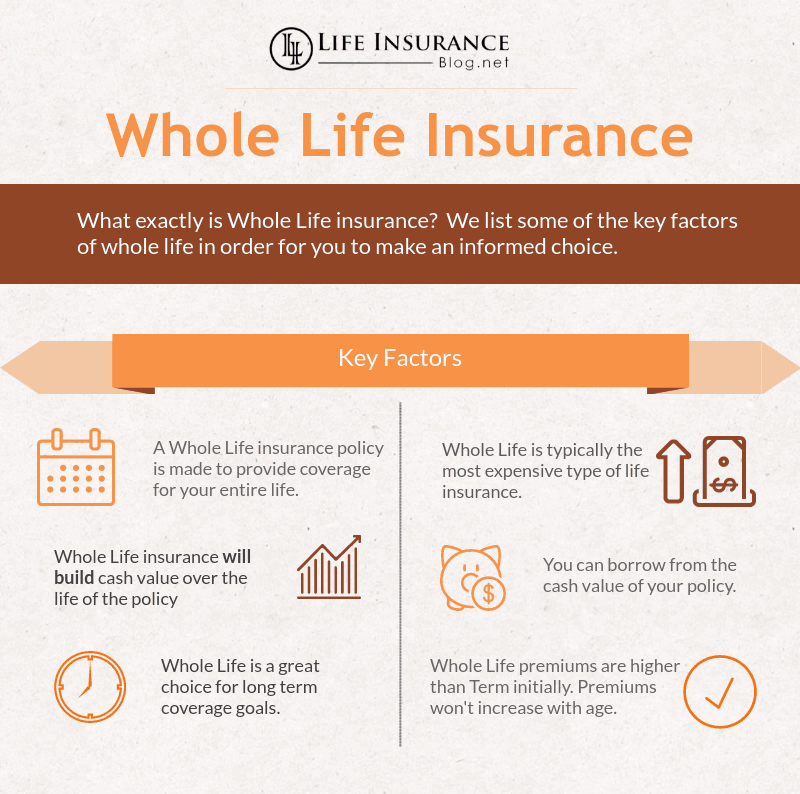

Life Insurance Types Explained Term Life Whole Life Whole life insurance is a permanent life insurance policy that has a fixed premium and death benefit. the cash value within a whole life insurance policy builds at a fixed interest rate, such as 2. Types of life insurance – policygenius. life insurance . types of life insurance. the most common types of life insurance are term, whole, universal, variable, and final expense. here’s how each type works and how you can find the right policy for your needs. by. amanda shih amanda shiheditor & licensed life insurance expertamanda shih is.

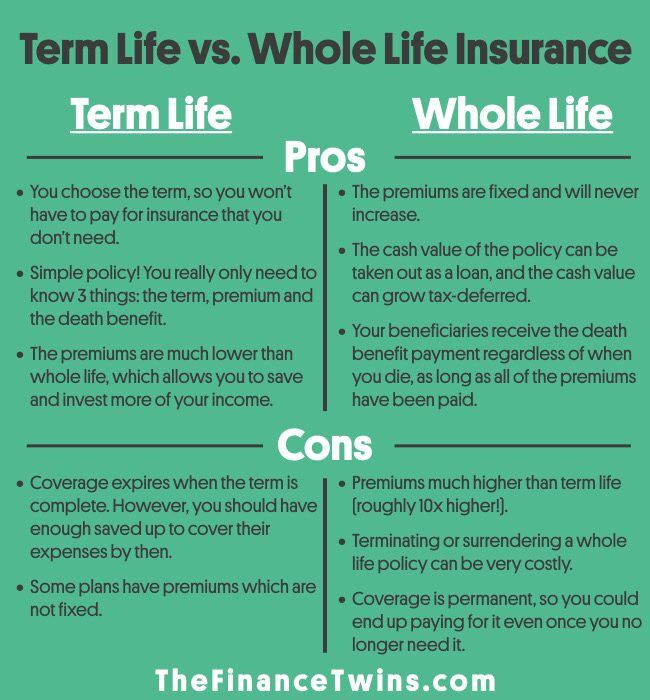

Term Life Insurance Vs Whole And Universal Life Insurance Life insurance policy types can be put into two main buckets: term life and cash value life insurance. one of the choices for cash value life insurance is whole life insurance. knowing the main. To get you started, here’s an overview of types of life insurance and the main points to know for each. term life insurance. whole life insurance. universal life insurance. burial insurance. Whole life is the more expensive, but predictable, permanent life insurance option. universal life, by contrast, gives you more flexibility in your premium, but may not provide as much of a return. Benefits of whole life insurance, explained . most whole life policies charge a level premium, meaning you pay the same monthly rate for the duration of the policy.(some companies offer a limited.

Here S The Difference Between Term Life And Whole Life Insurance Whole life is the more expensive, but predictable, permanent life insurance option. universal life, by contrast, gives you more flexibility in your premium, but may not provide as much of a return. Benefits of whole life insurance, explained . most whole life policies charge a level premium, meaning you pay the same monthly rate for the duration of the policy.(some companies offer a limited. When you start looking into life insurance plans, there are two main types: term and permanent. term life covers you for a limited period, while permanent can stay in place for the rest of your. How whole life insurance works. whole life insurance guarantees payment of a death benefit to beneficiaries in exchange for level, regularly due premium payments. the policy includes a savings.

Comments are closed.